India has gained much importance as a market for cosmetics companies. The Indian cosmetics sector has exploded due to increased buying power among women in metropolitan areas, greater attention to beauty and fashion, and a burgeoning middle class. Local companies have tried to stay up as more multinational brands enter the country. However, a few Indian businesses have prospered as a result of their concentration on invention and cater to the unique demands of Indian girls.

India’s cosmetics market is rapidly expanding, with an annual increase rate (CAGR) of 9.6% predicted from $1.2 billion in 2020 to $1.6 billion in 2025, and fueled mostly by the quality and technologically aware customers. Millennials, who wish to enter the market themselves via cosmetics and those want to spend more money on it, are driving this increase. With such a significant opportunity in front of you, it’s more crucial than ever to get your name out there.

As per recent reports of Nykaa IPO one of our customers decided to do market research. With the data, we were able to assist them. This blog shows study of India’s top 10 cosmetics companies.

Using data gathered through our cloud-based online data extraction tool, X-Byte Enterprise Crawling performed an analysis of the Indian cosmetics market. We’ll utilize this market data to give insights on the beauty brands in this blog, which will cover the following topics:

- The gathering and preparation of data

- Insights on the cosmetics industry’s pricing and promotions

Data Collection

We used our own proprietary data scraping engine to harvest publicly available information from a big online beauty shop to gain early information on numerous cosmetics brands. There were 23015 entries in the primary data collection (This includes duplicates as well). To optimize the data coverage, we tested a variety of combinations.

Data Attributes

For each cosmetics brand, the below data fields are scraped:

- Brand: A logo represents a company’s name, such as L’Oreal.

- Sale Price: The offer price is the lowest price at which a product may be purchased. It is the price after all discounts have been applied.

- Entry and Exit Prices: The high and low valued items for a certain brand

- Average Discount Percentage: The average of every discount provided on a brand’s various items is known as the average discount percentage.

- Average Ratings: The overall number of star ratings provided to that particular product is known as the average number of ratings.

- Average Product Rating across Brands: This is the average product rating across all brands.

- The Discount Range for All Items: A discount variety indicates the number of products that are included in a certain discount range.

- Discount Statistics: This indicates the quantity of discounted and non-discounted items in every product.

Data Validation and Deduplication

Duplicates are one of the most significant issues in scraping product information. Deduplication is required when the data extraction procedure is completed, and we utilize the links as a reference to deduplicate. Deduplication is a built-in function of our web scraping technology, and it generates data in seconds.

After filtering duplicate products, the final data output had 15600 goods, meaning that 33% of the extracted data was duplicated. If you’re utilizing web scraping to acquire data, make sure you do some Q&A with it. When you scrape the data, you may encounter both coverage and data difficulties.

Which are the Tools Used for the Analysis of the Extracted Data?

We utilized the Jypyter notebook and Python Pandas to investigate the data for the analytics. Seaborn was also utilized as a plotting library. However, we choose Tableau Public to make the interactive visuals available to the public. As a result, we were able to derive the following conclusion:

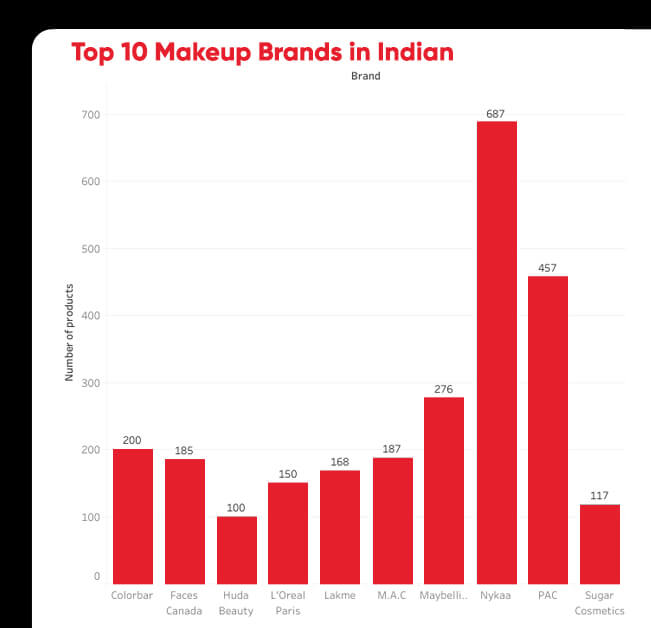

1. Top 10 Makeup Brands Filtered by Product Range

The online makeup retail website sells more than 15000 makeup items. Among which we listed out top 10 makeup brands that leads the market due to product varieties they offer:

The top 10 brands are:

Nykaa

Maybelline

L’Oreal Paris

Lakme

Sugar Cosmetics

Faces Canada

Colorbar

MAC

Huda Beauty

PAC

Nykaa came in first with roughly 687 goods on the shopping site, followed by PAC (457), Maybelline (276) and Colorbar (200).

The top 10 cosmetics companies are shown in this interactive graphic by product range.

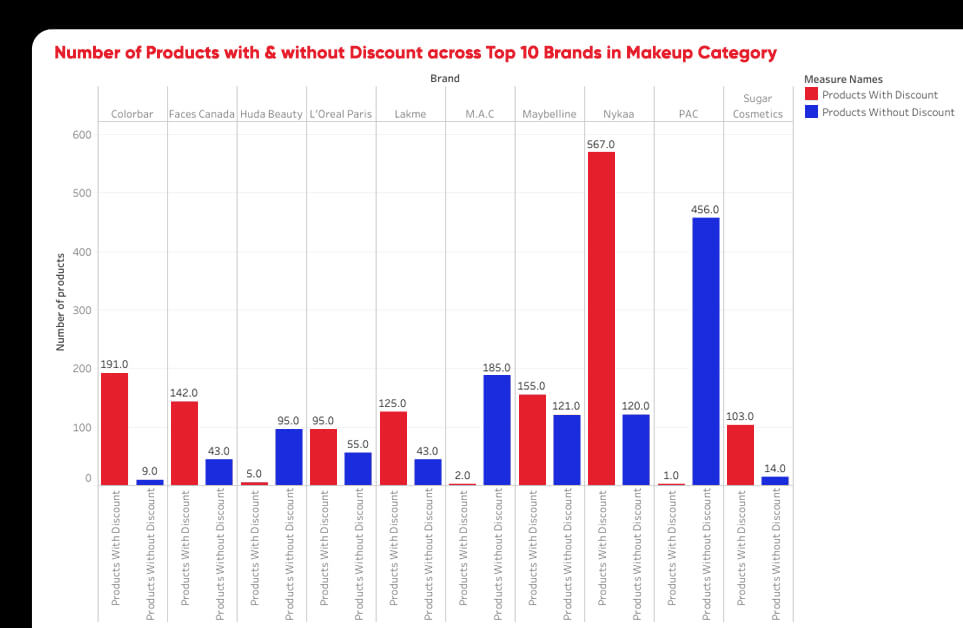

2. Brands With Offers and Without Offers

The main reason cosmetic firms provide frequent discounts is to encourage those who would not ordinarily buy makeup to do so, as well as people who are on the fence about purchasing a product to do so.

Due to many consumers are hesitant to test new things because of the expense, providing those with the option to do so at a reduced price can assist them overcome this barrier. Someone who is unsure whether or not they will enjoy a new gloss from our firm may be ready to give it a try if they know they will not be obligated to spend money on it if they do not like how it performs.

Brands also execute promotional programs in order to create brand loyalty in their consumers by making them feel good about the product purchase they made. Giving clients the option to save money makes them feel like they received a great deal, which motivates them to return for more discounts on things they enjoy.

We looked at how many goods were on sale at each of the top ten brands and came to the following conclusion:

- Nykaa has the most discounted products: 567 (82%), Colorbar had 191 (95.5%), and Maybelline had 155 (56.1%)

- PAC has the smallest amount of discounted goods (just one), followed by Mac cosmetics (2) and Huda Beauty (2).

It’s fascinating to watch how different discounting techniques are used by items in the same category.

Here’s a visual representation of the goods with and without discounts that you may interact with.

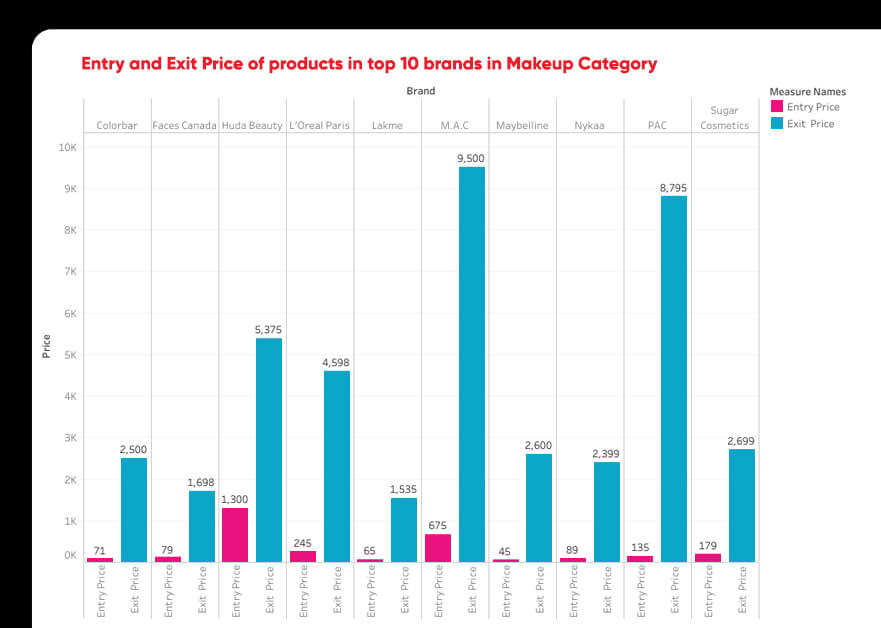

3. Entry & Exit Prices of Product for Every Product

The Exit and Entry pricing of items in a certain brand represent the low and high prices at which a product may be purchased. The price range in which the brand offers its items is represented by these figures.

We looked at the prices of entry and exit for the top 10 makeup brands and discovered the following:

- Maybelline has the cheapest entrance price of Rs 45 (i.e., Maybelline’s cheapest product is Rs 45).

- Huda Beauty has the most expensive entrance price of Rs 1300 (i.e., Huda Beauty’s cheapest product is Rs 1300).

- MAC (Rs 9500) has the highest departure price, followed by PAC (Rs 9500). (Rs 8795)

Below shown is the chart showing minimum and maximum product rates among major 10 makeup brands:

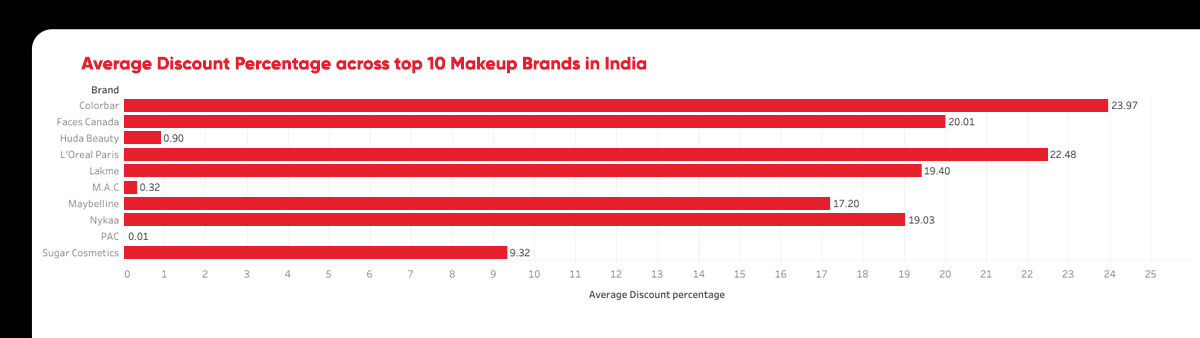

4. Average Offers and Discounts Percentage

The average sale % refers to a brand’s average discount on its items.

This is crucial for beauty firms since giving discounts may be a powerful method to entice clients and increase sales. Customers may develop the notion that they should only shop when there are discounts if a brand gives too many discounts.

Keep track of your typical discount % so you know what’s usual for you and how much discounts you are offering. This number may be used to compare how different brands discount their items and to figure out which brands provide higher or lower discounts.

We looked at the average offer percentages of the major 10 cosmetic companies and came up with the following results:

Colorbar had the greatest average discount percentage of 23.9%, followed by L’oreal Paris with 22.48 %. PAC gave the lowest average discount percentage of 0.01%.

The average discount percentages provided across goods in the top 10 cosmetic companies are seen here.

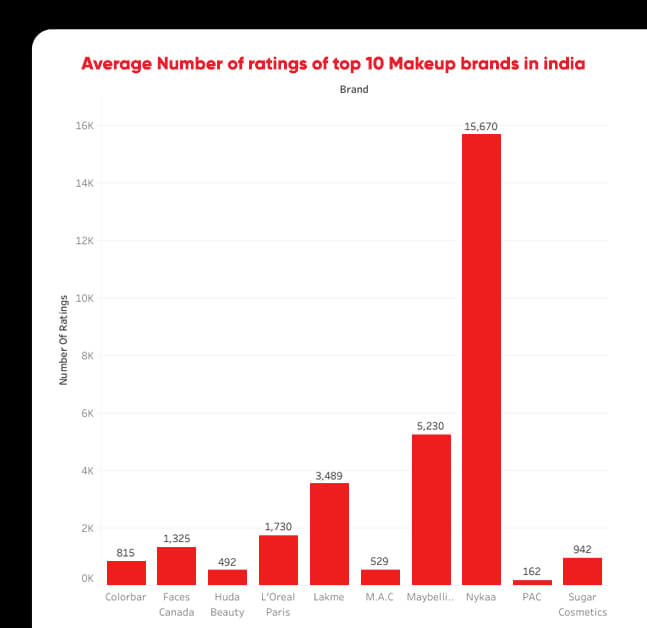

5. Number of Ratings

In the beauty market, a brand’s total number of ratings is considered an important factor to measure performance and potential. Product reviews are an important part of a beauty brand’s consumer experience. A product’s excess of favorable reviews may be a benefit, since it provides buyers trust in the product’s quality and efficacy. When clients are provided with a large number of alternatives, it also assists them in narrowing down their choices. A large number of rating is nearly always preferable than a small number of ratings since it tells potential buyers that the product is worth trying.

We analyzed about how many people rated the major 10 cosmetics companies and discovered as follows:

- The beauty brand Nykaa received the most customer reviews (15,670), followed by Maybelline (5230) and Lakme (5230). (3489).

- The brand PAC received the fewest votes: 162.

Below graph shows the number of ratings of the top 10 makeup brands:

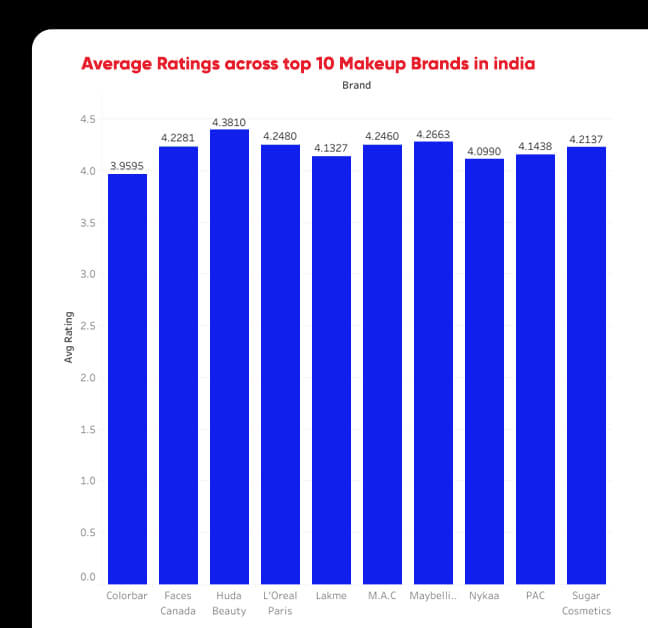

6. Average Ratings

Average rating for a brand is an important factor for any beauty brands. Aggregate rating of any brand is the average evaluation of all the brands and will help clients searching for a product of a specific brand or those who are trying to search for something new.

Knowing your brand’s average ratings may also help you see trends inside your own company—you could notice that some items routinely receive higher ratings than others, indicating that you need to change your manufacturing process or ingredients to better meet customer expectations.

We looked at the average rating of the top ten beauty companies and came up with the following results:

- Huda Beauty received the largest average score of 4.4, while Colorbar received the lowest score of 4.

- Sugar cosmetics, L’Oreal Paris, MAC, and Faces were the four brands with the highest average of 4.2.

Here’s a graphic representation of the top ten cosmetic brands’ average ratings.

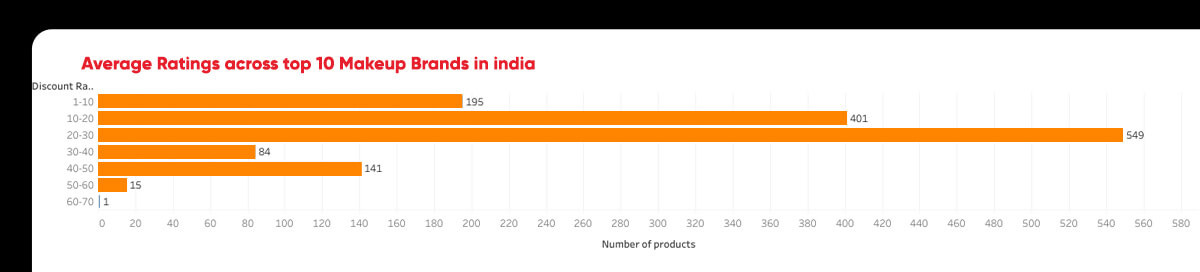

7. Discount Range across Products

The gap between the highest and lowest discounts provided on a brand’s items is measured by the discount range across products. Brands with a wide discount range may be more likely to give reduced pricing on their most expensive items, whereas brands with a narrow discount range are more likely to offer consistent reductions regardless of the item’s price.

Discounts may be a powerful sales tool, but firms must consider the influence they have on customer perception.

How Much Cost is Excessive?

We questioned beauty customers how much a “discount range across goods” would affect their opinion of a brand in our poll.

We discovered that offers of up to 30% can have a favorable effect on customer perceptions. Discounts of more than 30%, on the other hand, might lead to bad views.

What Does This Signify for Cosmetics Companies?

Brands must carefully evaluate how discount ranges and placement will affect the overall impression of their brand and the items they offer when deciding on discount ranges and placement.

We looked at the bargain ranges of the top 10 cosmetic companies and discovered the following:

- There were no discounts on 45% of the items (1141 products) out of a total of 2527.

- The most prevalent discount rate is 20-30%, with this range accounting for 21% of all goods (549 total).

- The second most popular discount range is 10-20%, with 15% of all goods (401 products) falling into this category.

- Only one product came into the 60-70 percent discount area, which is the maximum range.

The discount range in which goods from the top 10 cosmetic companies fall is visualized here.

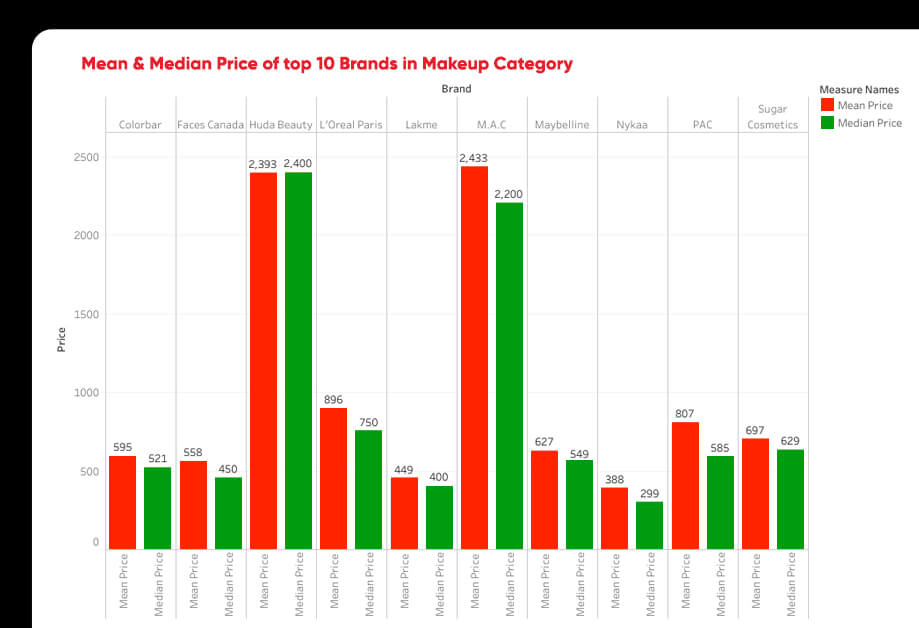

8. Mean & Median Prices

Although the terms mean & median pricing for cosmetic brands are sometimes interchanged, they refer to separate data points. The average rate of all items sold in a certain line or category is known as the mean price. The most frequent pricing value for a particular brand is represented by the mean value.

The median rate is the average price of every item sold in a certain line or category. This is excellent for firms who want to evaluate if their product pricing skews high or cheap in a certain category, as well as brands with a wide variety of product prices.

We looked at the average and median prices of the major 10 cosmetic brands and discovered the following:

- Huda Beauty have the highest average price, Rs 2393, followed by MAC (Rs 2432), while Nykaa had the lowest average price, Rs 387.

- Huda beauty products have the highest median price (Rs 2400), while Nykaa goods have the lowest median price (Rs 299)

The mean & median pricing for the major 10 cosmetics brands is shown in this interactive graphic.

Final Words

This blog is to provide readers with a better knowledge of the Indian cosmetics business. Scraping cosmetic brands will allow to better forecast their targets and focus on critical variables to build the business in this constantly increasing industry by analyzing previous and future market patterns.

Every year, new product releases are made in the Indian cosmetics sector, which is worth billions of dollars. Our goal was to provide you a better knowledge of how the beauty market operates, what kind of goods are in demand, and what stores can perform for the competition. We intend to give familiar insights and outcomes from our data scraping services to merchants throughout India who wish to go with flow.

Contact X-Byte Enterprise Crawling for any web scraping services today or request for a free quote!