What is Sentiment Analysis (Sentiment Monitoring)?

Sentiment analysis or monitoring is the categorization, collection, as well as analysis of text with methods like NLP (Natural Language Processing) as well as multiplication linguistics. This type of analysis assists companies in better understanding how the consumers respond to any particular products and brands. Human expressions are categorized as positive, neutral, or negative. Generally, companies try to measure whether or not the customer’s reply is negative or positive. For that reason, sentiment analysis is easy to understand in case, the unclear or neutral language gets funneled out from the research as well as the separation between negative and positive language is highlighted. After all, for a huge organization like Google, it is easy to alter marketing tactics in case, there’s a strong agreement about accessible services.

More precisely, while doing sentiment analysis, different market researchers could tell where the room to grow in the company is. For instance, depending on collected data, a company may observe that buyers react well to the customer service but are not happy with the product quality sold. Because of contemporary technologies, leaving comments or reviews is an easy and fast action on the consumer’s part. Amongst the key reasons for using sentiment analysis is automating the procedure of collecting all the accessible feedback. By automating the procedure, businesses can remove unhelpful text as well as know what shoppers need.

Python is the most generally used language when comes to NLP and sentiment analysis. It could be attributed to easy learning curves as well as the presence of different third-party libraries. All the libraries are available with in-built functionalities, which you require to work on the top of data. Knowing the math behind the functions is non-compulsory. Anybody can utilize these functions depending on outcomes, which are to be imitative as well as the accessible data.

Some common functionalities, which we utilize while breaking the text for evaluating it include:

- Lemmatization: It is used for finding associated words, as well as it varies from stemming because of higher complexity as well as needs extra time. One example of that might be to convert the best to good, or quantities to quantity.

- Stemming: Convert words into base forms, for instance walking would get converted into the walk.

- Tagging Parts of Speech: It involves the usage of built-in functionalities, which label different parts of texts grammatically.

- Tokenization: Breaking larger sentences into individual words.

The Procedure of Opinion Mining

Opinion Mining or Sentiment Analysis is the sub-branch of NLP, which deals with text classification into various headings including happy, neutral, or sad. Often Negative or Positive replaces sad or happy. In the case of a huge amount of data, you may even observe 5 headers having 2 in between getting moderately negative and moderately positive.

It is generally used on shorter texts like comments or tweets to get higher accuracy. If you utilize it on a larger paragraph that might have different emotions in that algorithms need to get disordered as well as produce imprecise results. In addition, for bigger pieces of text, final sentiments, which are expressed could be a subjective clarification– something, which NLP – depending on tools can’t deal with yet.

Sorting Tweets Depending on Sentiment

The most general data, which is analyzed to conduct sentiment analysis is tweets. Therefore, we would be showing usage of amongst the most general sentiments analyzer function in Python on the series of tweets. The 4 keys, which have been clear after importing tweepy and nltk, are given by Twitter when you use them for developer’s access, through answering some basic questions.

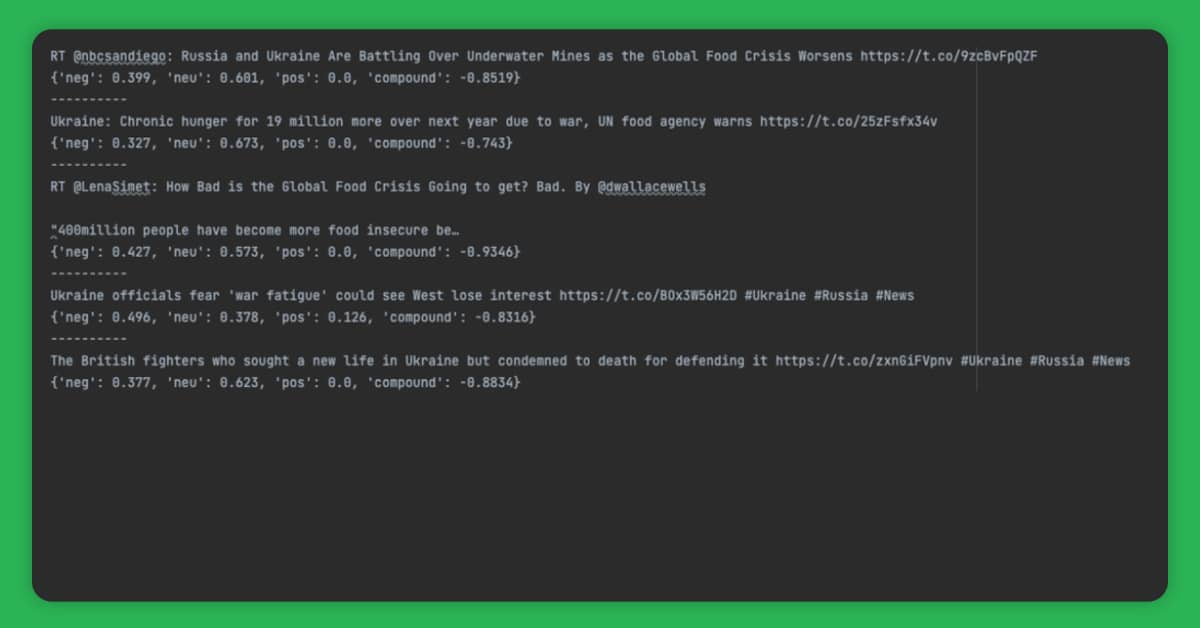

At X-Byte, we search for different tweets having Russia or Ukraine, these two countries, which are at front of the World News as well as that are expected to get tons of references in tweets. For every tweet, we have analyzed the sentiments related to that as well as printed a tweet and sentiment metrics if negative or positive sentiments related to that is more than 30%. You might select different values depending on use cases.

We have given some results here. As you can observe, the ‘neg’ or negative value associated with every text is greater than 0.3 (or 30%) and the ‘pos’ or positive value is nearly 0.0 for all the tweets. It is expected as tweets debating war or its effects are almost negative.

Similarly, one can get online texts including comments or tweets, or articles having mentions of the company names, affiliates, CEOs, and more to find if any positive or negative content has got published. If such content is available, the subsequent step might be to value its possible effects on stocks of the brand.

What Impact Sentiment Analysis Has on the Financial Sector?

Reddit, a discussion and news aggregation board site, has newly had a huge impact on the the financial sector as well as the stock market. Inh January 2021, the retail investors had decided to undertake Wall Street in the event that was later known as “GameStop short Squeeze”. The users of the subreddit wallstreetbets contributed heavily in purchasing stocks of GameStop as well as some others and increasing stock prices, thus “squeezing” short positions apprehended by Wall Street.

It was expected to be the reprisal for Wall Street staking against GameStop, a brick-and-mortar game store, which was exaggerated by the COVID-19 pandemic like other businesses. For covering the losses, hedge funds need to purchase GameStop stocks themselves, pushing the prices even higher. Too much volatility in the market has resulted in general retail brokers including Robinhood for stop trading in definite stocks as they didn’t have collateral about clearing houses to execute trades. All these resulted in more frenzy, lawsuits, and accusations.

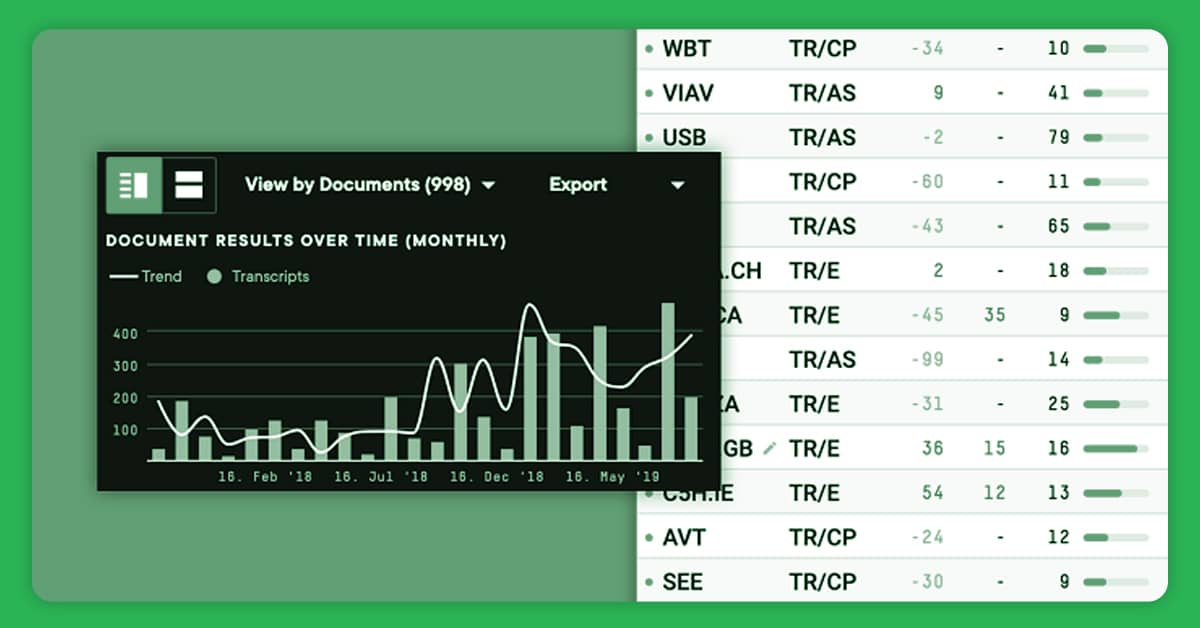

As Social Media wasn’t getting actively monitored nor were the effects factored with the risk models used by financial institutions, various events like these might not get predicted. Whereas institutional buyers are anticipated to get a huge hand in knowing how the stock market performs, social media discussions and trends can get an even bigger impact. Furthermore, the volatility because of such changes might cross thresholds, which might get deemed to become hard barriers. Businesses specializing in creating financial models would require to utilize social media sentiment analysis and the newest news articles for better market judgment.

If you want to know more about our Sentiment Analysis services, then contact X-Byte Enterprise Crawling.