Distances are great in the United States, which is the fourth-largest country by area. More people in the United States commute by car than in any other country. As a result, travel, whether for business or pleasure, is impossible without an automobile. If someone is flying to Minneapolis for a work meeting or Denver for a ski trip, they will need to rent a car.

For instance, the approximate price for a 3-day weekend rental car is 150$ which will exclude insurance, Gas, Tolls, and other extra expenses. The average rate of Airfare is US= 350$ which is quite expensive.

Strategy for Data Collection and Description:

This blog will show an analysis of scraping a specific car website for a 3-days weekend trip. There are rental variations that depend on the category of the car.

Mid-size Sedan

At the very least, it is the most commonly reserved car; nevertheless, customers can usually opt for a less expensive economy car or a full-size sedan. Prices are typically within $5–10 dollars of one another. As a result, it’s a reasonable option.

Choice of a weekend rental

Car rental firms frequently provide discounts for the weekend or weekly rentals. Mainly because they want to make better use of their assets. It’s intended to use this as a non-business travel dataset, so a weekend rental appears to be the best option. From Friday to Sunday.

Which to Choose: A Random Weekend or a Larger Dataset?

Ideally, it is preferred every single day, but there is not a single public data set available and hence scraping price variations regularly is the only option. Several companies that do not allow to scrape the data and so it becomes difficult to deal with them.

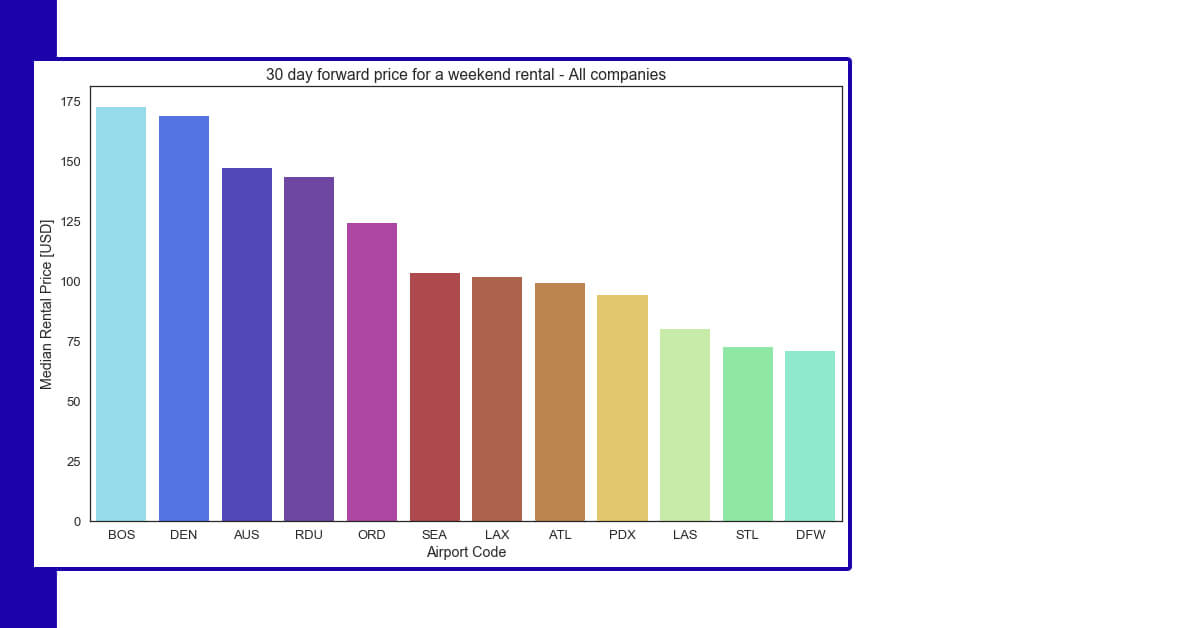

We wanted a combination of larger airports and mid-size hubs, as well as geographically diversified locations that account for seasonality. Rental vehicle passengers in mid-size cities like Austin, St. Louis, and Las Vegas may be much higher than in NYC, where Taxis and Public Transit rules over the city.

East — Atlanta [ATL], Boston [BOS] & Raleigh / Durham [RDU],

Central / Mid-West Chicago O’Hare [ORD], Denver [DEN] & St. Louis [STL].

South West — Dallas [DFW] & Austin [AUS].

Mountain — Las Vegas [LAS]

West Coast – Los Angeles [LAX], Seattle [SEA], Portland [PDX]

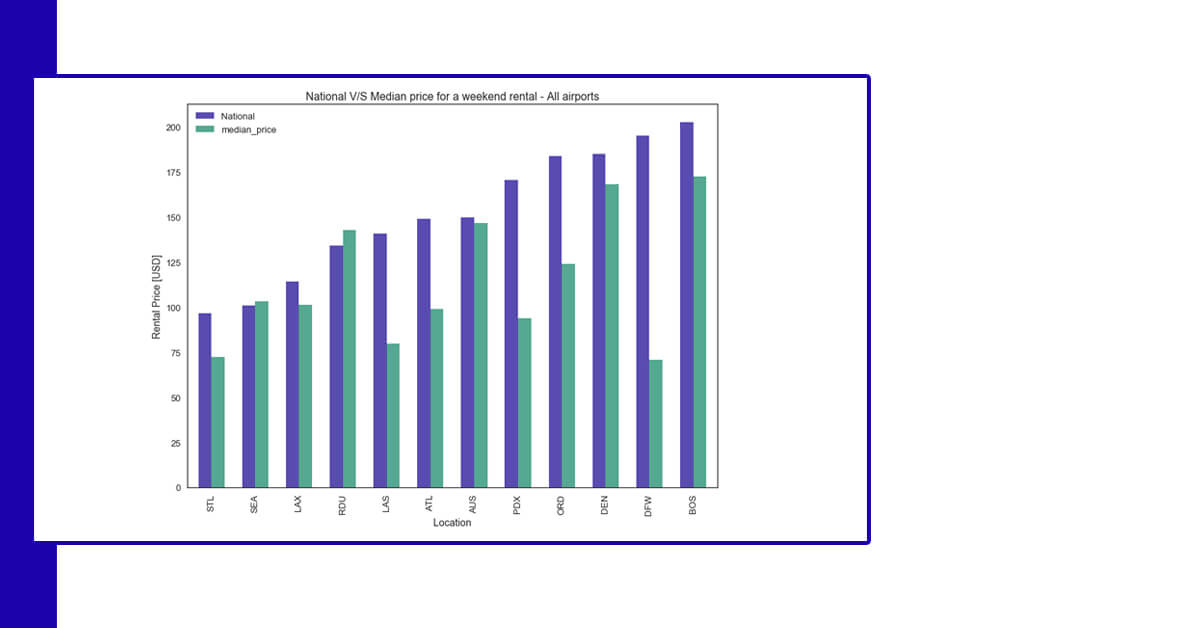

The cost of a rental car is obviously determined according to where you rent it. As Boston and DFW are on opposite ends of the spectrum, there appears to be no association between airport size and pricing. St Louis and Austin are as well.

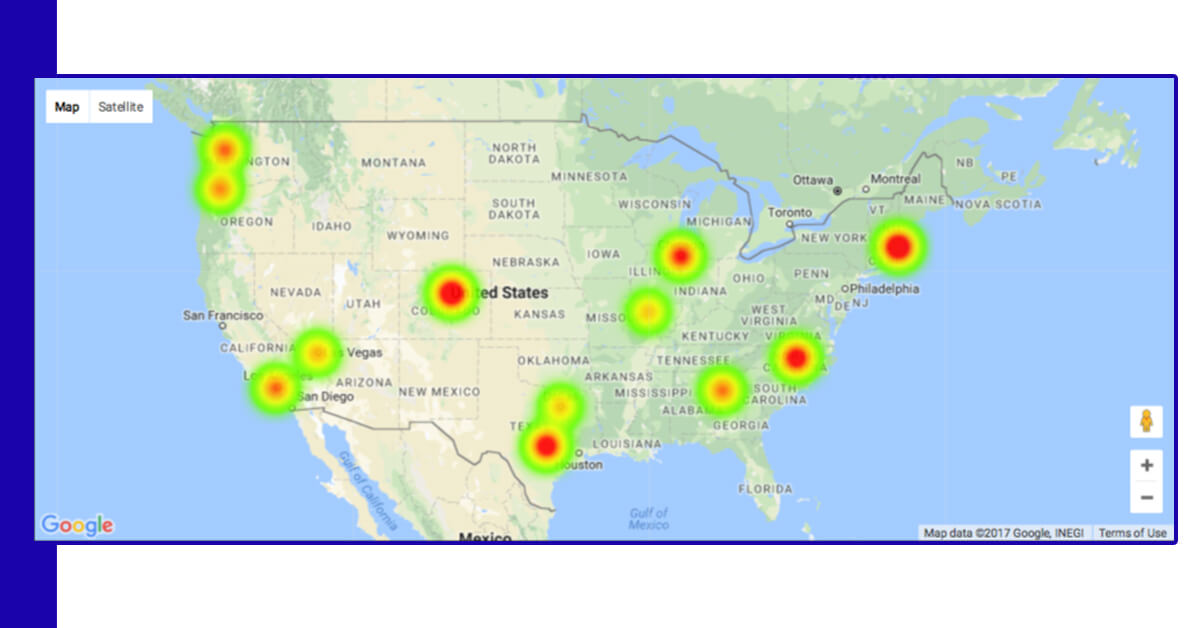

The above data has been represented as a heat map on Google Maps.

Car Rental Companies

The data above depicts airport prices as a whole, regardless of the company or consumer sector they serve. A quick tutorial on rental firms can be seen in the image below. The following is how the industry has merged:

Enterprise is the owner of: National, Enterprise, and Alamo are among of the most well-known companies in the United States

Avis owns the following properties: Avis, Budget, and Payless are three of the most well-known car rental companies.

Hertz is the parent company of Hertz, Thrifty, and Dollar.

The levels in the image below demonstrate this: Corporate -> Corporation & Leisure -> Lowest Priced Tier.

Even though that they are owned by the same corporations, service levels and customer service differ significantly, as shown below.

Customer Service Scores = Average of evaluations gleaned from a travel website.

National: 5 / 5 Stars

Enterprise, Hertz and Avis: 4 / 5 Stars

Alamo: 4 / 5 Stars

Budget, Payless, Thrifty, Dollar and Sixt: 2 / 5 stars

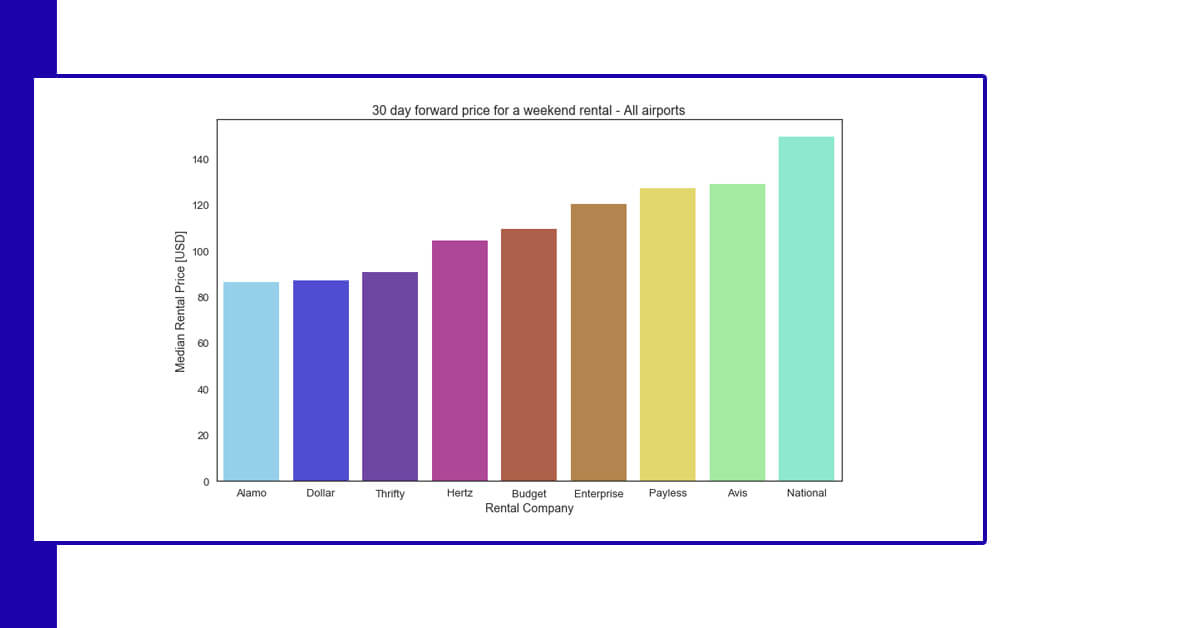

Median Prices by Car Company

Forward prices for 30-day Mid-Size or higher car for a 3-days weekend trip will be adjusted for promotional codes.

30-days forward price for Mid-Size or higher car on a 3 day weekend (Friday — Sunday) adjusted for promotional codes [wanted this as otherwise they are inflated prices usually].

The evidence merely backs up what we said about the importance of branding and concentration in this business. With greater service and a higher price, National caters to the elite class of customers. Dollar and Thrifty, on the other hand, are on the lower end, as expected.

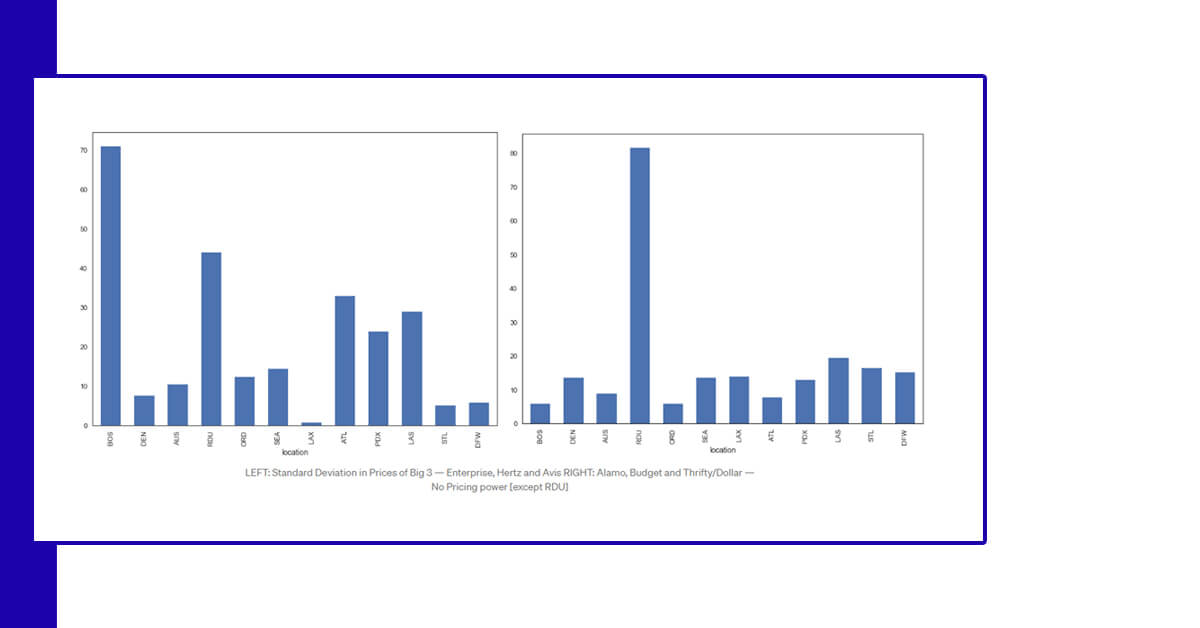

Standard Deviation of Prices

In an airport, the dispersion of costs around the mean price

Left: Enterprise, Hertz, and Avis — Pro Segment

Right: Alamo, Budget, Thrifty and Dollar — Cheaper Segment

People consider all vehicle businesses in a segment to offer identical products. The lower level — Alamo, Budget, Thrifty, and Dollar — is far worse. The standard error of pricing by airport is 20$, according to the graph above on the right [delete RDU, it’s an anomaly due to inventory shortage].

On the left: It’s a little clearer, but you can add any histograms to visualize the distribution for the sake of brevity. Due to one outlier, almost everyone strives to stay within the same range.

The conclusion for the above analysis will be: there will be NO COST POWER in a segment.

It’s no surprise that Avis and Hertz are ailing after acquiring the lower-cost firms. Over the last five years, both stocks have had negative or flat returns. So the entire market has become commoditized, and no one can set prices.

With a few exceptions, National virtually always outperforms the location’s median price by a wide margin. Plus, as an extra sweet spot, they have a loyalty program that allows you to reserve a mid-size and get any vehicle on the lot. As a result, they can justify the prices.

For further details, Contact X-Byte Enterprise Crawling today!